Sub-Saharan Africa continues to be a region of great allure for investors, with a multitude of countries presenting compelling opportunities for future investments. Here’s an elaborative overview of the top 10 African countries for future investments in Sub-Saharan Africa, as presented by Business Insider Africa and KPMG, with a special spotlight on Uganda.

- South Africa (50%): South Africa is a regional economic powerhouse, with well-established infrastructure, financial markets, and a diverse economy. It’s a popular choice for investors due to its strong business environment, abundant natural resources, and a developed financial sector.

- Nigeria (30%): Nigeria, as one of Africa’s largest economies, offers numerous investment opportunities. It boasts a large consumer base, a growing tech industry, and abundant oil and gas reserves. However, investors should also be mindful of regulatory challenges.

- Tanzania (15%): Tanzania’s economy has been growing steadily, making it an attractive destination for investment. The country offers opportunities in agriculture, mining, and infrastructure development.

- Ghana (14%): Ghana has a stable political environment and is known for its friendly investment policies. The country is rich in natural resources, and sectors like mining, agriculture, and energy offer significant potential for investors.

- Kenya (14%): Kenya is a regional hub for finance and technology. It’s a hotspot for tech startups and offers opportunities in sectors like agriculture, real estate, and renewable energy.

- Mauritius (14%): Mauritius is a financial and business services hub with a favorable investment climate. It’s often used as a gateway for investments into Africa and offers a stable regulatory environment.

- Zambia (11%): Zambia’s economy is largely dependent on copper mining. However, the country is diversifying into agriculture, energy, and tourism, making it an interesting prospect for investors.

- Uganda (10%): Uganda is rich in agricultural resources and offers opportunities in agribusiness, energy, and infrastructure development. It’s seen as a frontier market for investors.

- Mozambique (6%): Mozambique has significant natural gas reserves, which have attracted investment in the energy sector. Infrastructure development and agriculture are also promising areas for investors.

- Zimbabwe (6%): Zimbabwe is working to revive its economy after years of challenges. The country has abundant natural resources, and there are opportunities in mining, agriculture, and infrastructure development.

These countries are seen as promising investment destinations due to factors such as economic growth potential, market size, resource availability, and regulatory environments. However, it’s crucial for investors to conduct thorough due diligence, understand local regulations, and assess risks before making investment decisions in any of these countries.

Spotlight on Uganda’s potential

Uganda is increasingly catching the eye of savvy investors, with the country’s investment climate becoming more conducive for foreign direct investments. Here, we explore the areas of investment potential and the government policies that are facilitating this growth.

- Agriculture and Agribusiness: Uganda’s fertile land and favorable climate make it a prime destination for agriculture and agribusiness investments. The government has introduced various incentives to encourage investments in this sector, including tax breaks and land lease options. Crop cultivation, animal husbandry, and food processing are thriving industries in the country.

- Renewable Energy: With a growing demand for electricity, Uganda offers substantial opportunities in renewable energy projects. The government has been actively promoting investments in solar, wind, and hydroelectric power, with incentives such as tax exemptions and tariff guarantees. The country is making strides in harnessing its energy potential to meet the needs of its population and beyond.

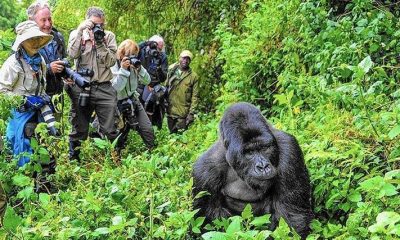

- Tourism and Hospitality: Uganda’s breathtaking landscapes, diverse wildlife, and cultural heritage have positioned it as a burgeoning tourist destination. The government is committed to promoting the tourism sector, offering investment incentives such as tax holidays and support for the construction of hotels and other infrastructure. Uganda’s tourism sector presents attractive prospects for hoteliers, tour operators, and investors in eco-tourism.

- Infrastructure Development: Infrastructure development is a priority for Uganda’s government, and foreign investors are playing a vital role in this sector. The construction of roads, bridges, and ports is on the rise, creating opportunities for foreign companies to engage in these essential projects. The government offers various incentives, including tax relief and reduced import duties on construction materials.

- Manufacturing and Industrialization: Uganda’s strategic location within East Africa makes it an ideal location for manufacturing and industrial investments. The government has implemented policies aimed at promoting local production and boosting export potential. Investors in manufacturing sectors such as textiles, pharmaceuticals, and consumer goods can benefit from these policies.

Government Facilitation: Uganda’s government has adopted a series of policies and incentives to encourage foreign direct investment. These include:

- Investment Protection: Uganda offers strong legal protection to investors, ensuring the security of their investments in the country.

- Tax Incentives: The government provides tax holidays and reductions in corporate income tax rates for specific sectors and projects, making it more attractive for foreign investors.

- Trade Agreements: Uganda is a member of various regional trade agreements, which facilitate access to regional markets and enhance the export potential of invested businesses.

- One-Stop Centers: The government has established one-stop centers to streamline investment processes and provide support to investors throughout their projects.

Uganda’s growing prominence in the Sub-Saharan African investment landscape is indicative of its potential as a thriving hub for foreign direct investments. With its diverse opportunities across various sectors and government policies aimed at fostering a conducive investment environment, Uganda is well poised to attract a new wave of investors seeking growth in this dynamic African economy.