Uganda’s Inflation Trends: A Closer Look at September 2023

Uganda has seen notable shifts in its inflation landscape in the month of September 2023, as reported by the Uganda Bureau of Statistics. These changes reflect both monthly and annual variations in inflation across different sectors, with implications for the broader economic landscape. Let’s delve into the key highlights:

1. Headline Inflation

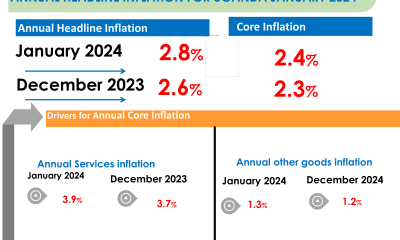

In September 2023, Uganda’s monthly headline inflation rose by 0.7%, compared to the 0.6% registered in August 2023. However, the annual headline inflation rate slowed down to 2.7% from a 3.5% decrease in August 2023. This suggests a relatively stable pricing environment, signaling potential macroeconomic stability.

2. Core Inflation

Monthly core inflation also saw an uptick, rising by 0.3% in September 2023 compared to 0.2% in August 2023. The annual core inflation rate slowed to 2.4%, marking a notable 3.3% slowdown since August 2023. These numbers reflect underlying price trends and are critical for policymakers monitoring economic health.

3. Diesel and Petrol Inflation

Monthly Diesel and Petrol inflation also witnessed increases in September 2023. These fuel price increases can impact transportation costs and overall consumer prices, making them a significant factor in the inflation equation.

4. Regional Comparisons

Comparing Uganda’s inflation trends to neighboring countries reveals interesting insights. As shred by PSST Ramathan Ggoobi on his X space, Uganda’s annual inflation rate of 2.7% in September 2023 is notably lower than Burundi (28.8%) and the Democratic Republic of Congo (27.8%), but higher than Rwanda (17.4%), Kenya (6.8%), and Tanzania (3.3%). This data underscores Uganda’s relative price stability within the region.

5. Regional Disparities in Uganda

Within Uganda, inflation rates vary across regions. Fort Portal recorded the highest inflation at 5.1% for the 12 months ending September 2023, compared to 6.0% in August 2023. In contrast, Kampala High reported the lowest inflation at 2.0% for the same period, down from 2.5% in August 2023. These regional variations can reflect differences in economic activities and price pressures.

6. Residential Property Prices

The Residential Property Price Index showed a significant change, with annual inflation moving from -7.6% in Q4 FY2022/23 to 5.7% in Q1 FY2023/24. This indicates a rebound in the real estate sector, with Kampala Central & Makindye experiencing a substantial rise to 19.2% from -15% in the previous quarter. However, ‘Kawempe & Rubaga’ and Nakawa registered more moderate changes at 2.8% and 0.6%, respectively.

7. Construction Sector

The construction sector inflation in Uganda registered at 1.8% in the year ending August 2023, a slight decrease from 2.0% in July 2023. However, on a monthly basis, there was a 0.2% increase in August 2023 compared to a 0.1% rise in July 2023, indicating some volatility in this sector.

8. Macroeconomic Stability

Economist Ramathan Ggoobi (@rggoobi) believes that Uganda is on track to achieving full macroeconomic stability. The reported inflation figures play a crucial role in assessing the overall economic health of the country.

In conclusion, Uganda’s inflation landscape in September 2023 reflects a mixed picture of stability and change, both regionally and across sectors. Policymakers and businesses will closely monitor these trends to navigate the evolving economic landscape.