Uganda’s position as the fourth-ranking nation in the Absa Africa Financial Markets Index for 2023 remains unchanged, despite a marginal decline in its overall score from 64.4 to 62.8. The index, which evaluates financial market development across African countries, sheds light on Uganda’s areas of progress as well as areas needing attention, particularly in foreign exchange accessibility and local investor capacity.

A notable contributor to Uganda’s slight downturn was a weakened performance in foreign exchange access, with a 10-point drop in the corresponding pillar. Factors such as reduced interbank foreign exchange turnover and a decline in international reserves to $3.6 billion, equivalent to 3.4 months of import coverage, down from 4.6 months the previous year, were cited as reasons behind this decline.

Conversely, Uganda showcased advancements in its macroeconomic environment and transparency, retaining its second-place position in this category with a one-point increase in its score. The improvement stemmed from a modest decrease in external debt as a percentage of GDP and the country’s consistent high marks for policy transparency and macroeconomic data standards.

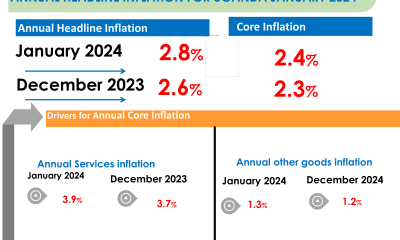

According to Jeff Gable, Chief Economist at Absa, Uganda’s inflation is anticipated to touch the 5% target briefly mid-year before settling at 4.4% by December 2024, with an average forecast of 4.2% for the year, compared to 5.4% in 2023.

In legal standards and enforceability, Uganda maintained its score at 85, reflecting advancements such as the adoption of netting legislation, aligning the country with international legal norms and potentially enhancing its appeal to investors.

However, the capacity of local investors emerged as an area for improvement, with Uganda’s score slightly declining to 14. This decline was attributed to a reduction in pension fund assets per capita, underscoring the necessity for initiatives to bolster domestic investment capacity.

Alan Lwetabe, Director of Investments at the Deposit Protection Fund of Uganda, emphasized the importance of creating a supportive environment for Ugandan businesses through measures such as tax incentives and financial market education.

Initiatives like the project to link central securities depositories and the ‘Okusevinga’ initiative, aimed at enhancing retail investor access to government bonds, are underway to strengthen market depth and liquidity.

Looking ahead, as Uganda navigates the intricacies of enhancing its financial market infrastructure, collaborative efforts among stakeholders from both the private and public sectors are deemed essential for the country’s continued progress in the Absa Africa Financial Markets Index.

Original article on Independent