Uganda’s Insurance Brokers Forge Strategic Alliance with UAP Old Mutual

In a bid to revitalize and streamline the insurance sector, the Insurance Brokers Association of Uganda (IBAU) recently joined forces with UAP Old Mutual, a leading player in the insurance industry. The collaboration was officially announced during a breakfast meeting held at Fairway Hotel on September 20th, 2023.

The meeting witnessed key representatives from both IBAU and UAP Old Mutual sharing insights and perspectives on the evolving landscape of Uganda’s insurance industry.

UAP Old Mutual’s Commitment to Excellence

During the event, Paul Muhame, the Chairperson of IBAU, lauded UAP Old Mutual for its unwavering commitment to employee training and resource provision, which have greatly contributed to sensitizing the insurance community.

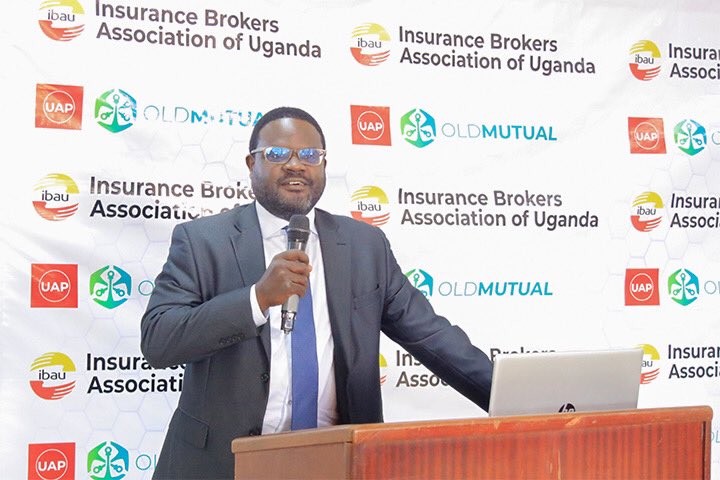

Patrick Kimathi, Managing Director of UAP Old Mutual Uganda, expressed gratitude to brokers for their valuable business contributions and commended them for their exceptional work. Kimathi’s recognition of the brokers’ dedication highlights the crucial symbiosis between insurers and brokers.

James Maguru, the General Manager of UAP Old Mutual Uganda, emphasized the company’s dedication to innovative solutions aimed at propelling the insurance industry’s growth.

Empowering Strategic Partnerships for Sectoral Advancement

Carol Tayebwa, Business Development Manager at UAP Old Mutual, extended her appreciation to IBAU and encouraged its members to maintain their efforts. She underscored UAP Old Mutual’s round-the-clock commitment to ensuring top-tier client service. Tayebwa’s remarks highlight the insurer’s dedication to delivering exceptional customer experiences.

The newly forged partnership between IBAU and UAP Old Mutual aims to streamline strategic alliances within the insurance sector, with a strong focus on information exchange.

Challenges and Opportunities in the Brokerage Industry

Arnold Baguma of Johnson Insurance Brokers issued a call for insurers to proactively engage with brokers instead of waiting for them to initiate contact. This proactive approach, he argued, could drive innovation and collaboration within the industry.

Sande Protazio, representing the Insurance Regulatory Authority, revealed plans for a comprehensive study to assess the impact of regulations on businesses. With over 50 insurance brokers in Uganda, Protazio stressed the importance of renewed efforts to elevate the industry, which has experienced stagnant growth. Currently, brokers hold a market share of 30%, in contrast to the rapidly expanding Bancassurance market.

Protazio attributed the disparity to the lack of proper data management in the brokerage industry. He underscored the need for data-driven strategies as a key driver of growth.

With a focus on collaboration, innovation, and data management, the insurance industry is poised for growth and enhanced customer service. As the two entities work hand in hand, stakeholders anticipate positive changes that will benefit both insurance professionals and consumers alike.