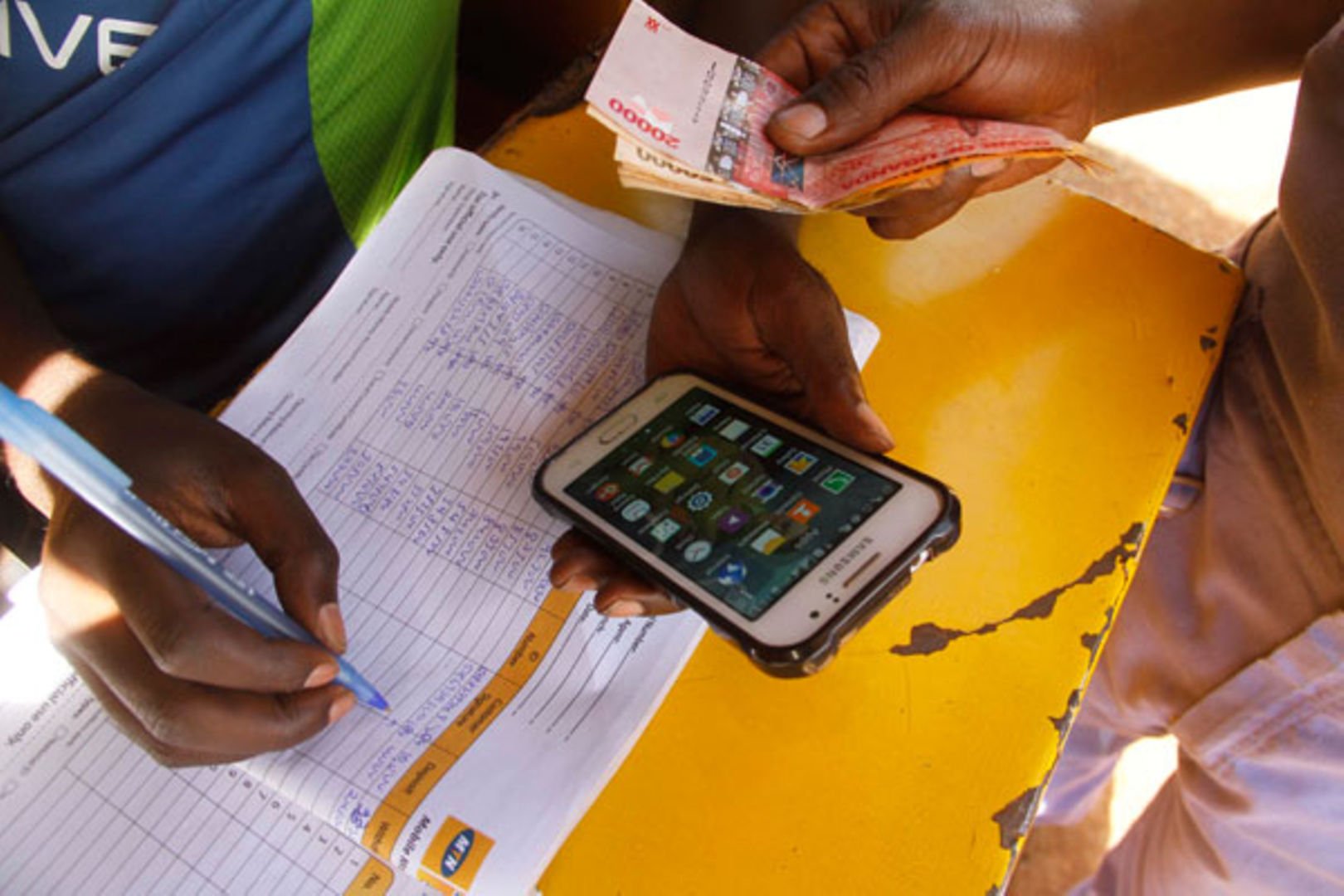

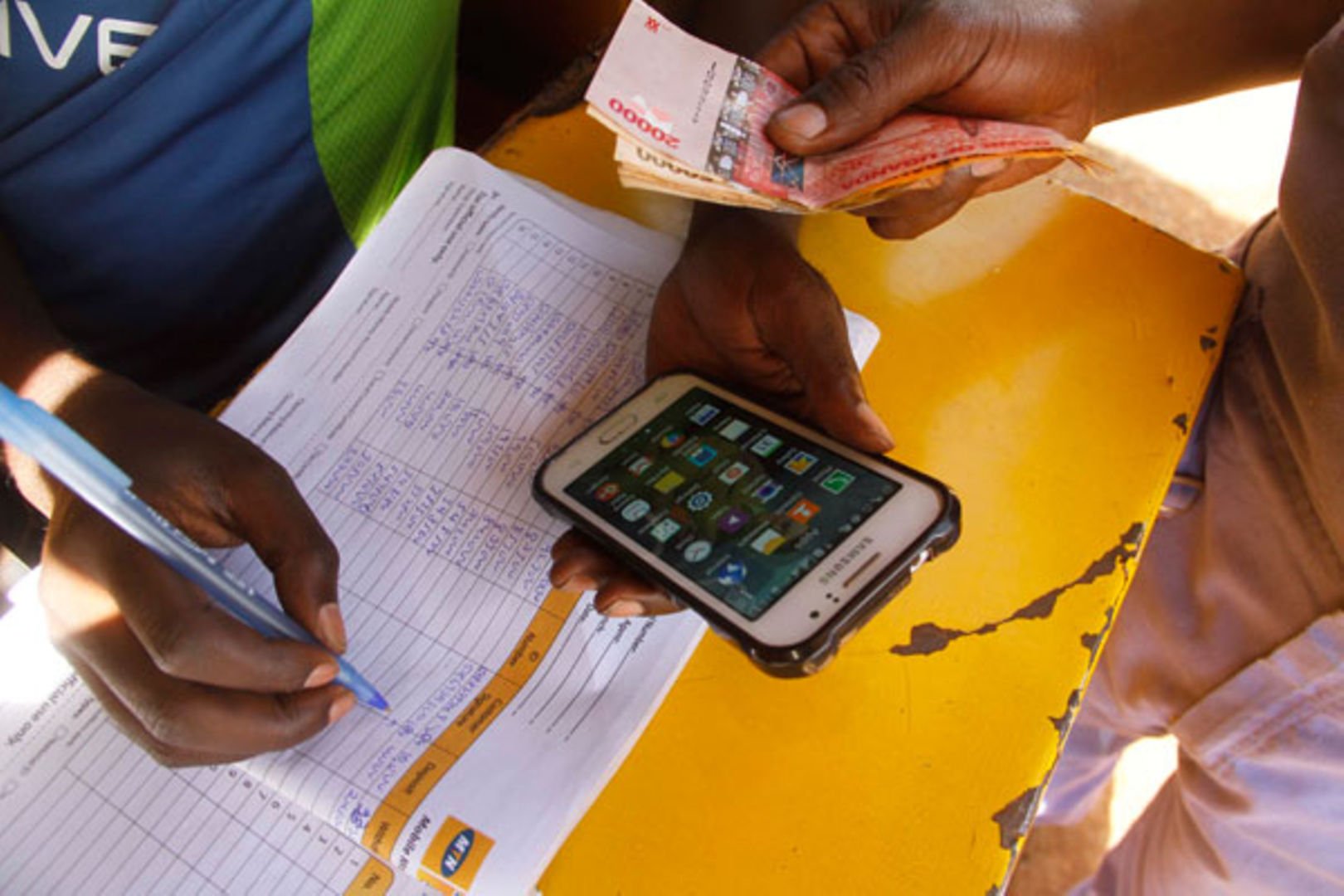

According to The Bank of Uganda’s annual report for the financial year 2022/23, approximately 93% of all mobile money transactions during this period did not exceed sh50,000 in value. These findings reveal intriguing insights into the dynamics of mobile money in the country.

Despite the preponderance of low-value transactions, the mobile money industry in Uganda has seen substantial growth. The report indicates that the total value of mobile money transactions increased by an impressive 22.6%, reaching sh191.3 trillion in June 2023 compared to sh156 trillion in June 2022. This substantial increase reflects the continuing trend of mobile money becoming a dominant force in the Ugandan financial landscape.

The transaction volumes also surged by 20.8%, rising from 4.8 billion to 5.8 billion over the same period. The numbers are clear – mobile money is playing a crucial role in facilitating financial transactions and payments in Uganda.

On average, each transaction was recorded at sh36,477 during the period under review.

The report further reveals that low-value transactions, valued at sh50,000 or less, dominated a significant 92.8% of all transactions. This suggests that mobile money in Uganda is primarily used for day-to-day, small-scale transactions, such as bill payments, airtime purchases, and small transfers.

Mobile Money’s Role in Financial Inclusion

Mobile money was introduced in Uganda in 2009 and has since become a pivotal driver of financial inclusion in the country.

According to the 2021 World Bank Global Findex Report, access to formal financial services in Uganda is reported at an impressive 66% of the population, compared to the Sub-Saharan average of 55%. This remarkable achievement can largely be attributed to the widespread penetration of mobile money services.

The number of registered mobile money customers in Uganda also continues to grow. As of June 30, 2023, there were 42.9 million registered mobile money customers, marking an 11.4% increase from the 38.5 million recorded in June 2022. However, it’s important to note that not all registered customers actively use the service. Out of the 42.9 million registered customers, only 26.4 million transacted at least once in the preceding three months, indicating that there is still room for further engagement and adoption.

Future prospects and challenges

The dominance of low-value transactions in mobile money suggests that the industry has great potential for further growth, as it can expand into more substantial financial services. This presents both opportunities and challenges for the industry, as it seeks to provide more diverse and sophisticated financial products and services to its user base.