According to a revelation from Mr. Richard Yego, the Managing Director of MTN Mobile Money, the mobile money pay platform in Uganda has witnessed an impressive surge, with an average daily transaction value reaching Shs8 billion.

He also revealed that the daily payments have doubled in the 12 months leading up to October 2023 and are projected to more than triple in the coming year.

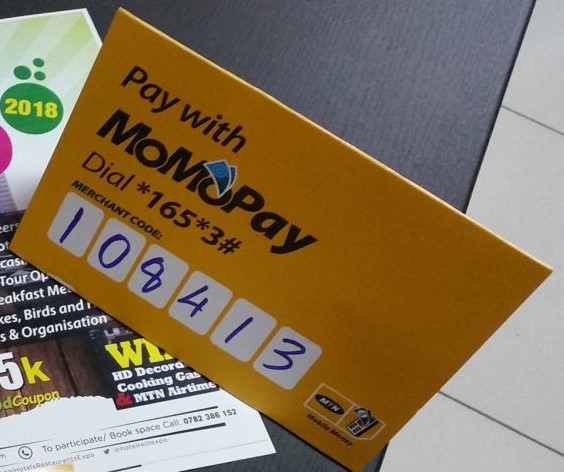

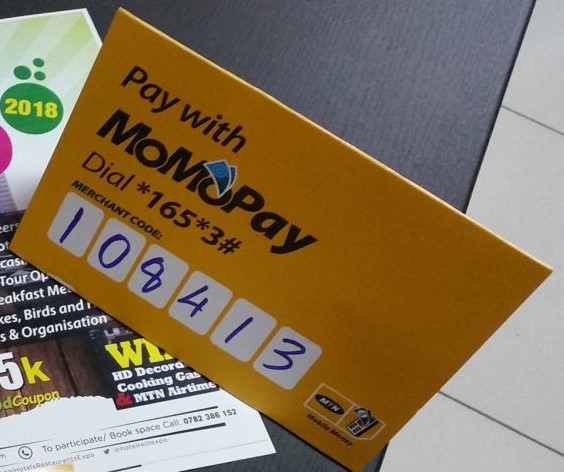

The data indicates a substantial increase in the adoption of digital payments, with merchant codes soaring by 15,000 to a total of 290,000 during the same period. This surge suggests a rapid uptake of digital payment methods since the launch of MTN mobile money pay in May 2019.

Mr. Yego highlighted that 80 percent of these mobile money pay transactions were for amounts less than Shs60,000, showcasing the platform’s popularity for everyday transactions.

Additionally, 15 percent of transactions fell within the Shs60,000 to Shs250,000 range, while 5 percent were in the Shs250,000 to Shs5 million bracket.

The significance of mobile money in moving towards a cashless economy was underscored, with the Bank of Uganda relying on technological advancements to reshape the payment landscape. Notably, during the period ending December 2022, MTN mobile money pay alone processed 10.8 million payments, totaling Shs1.2 trillion, indicating its dominance over other digital payment platforms such as debit cards, credit cards, and points of sale.

In a broader context, data from the Bank of Uganda revealed that debit cards led in terms of digital payments outside mobile money, registering 6.9 million payments worth Shs1.33 trillion. Points of sale recorded 4.7 million payments, amounting to Shs855.5 billion, while credit cards, totaling 99,400, showed a transaction volume of 320.9 payments and a value of Shs81.9 billion.

The momentum of MTN mobile money pay is undeniable, with a growth rate of 120 percent in volume and 72 percent in value between May 2022 and May 2023. These figures reflect the ongoing shift towards digital financial solutions and the increasing reliance on mobile money for a wide range of transactions.