MTN, Uganda’s largest mobile phone operator, has posted a remarkable 21.1% increase in its third-quarter profit after tax, reaching Shs 354.4 billion by the end of September 30, 2023. This surge can be attributed to a growing customer base and surging demand for data and fintech services.

Service revenue simultaneously witnessed a substantial increase of 15.2%, reaching Shs 1.9 trillion during the same period. As a result of this outstanding performance, the company’s board has approved a second interim dividend of Shs 6.0 per share, up from the previous year’s Shs 5.4.

Sylvia Mulinge, CEO of MTN Uganda, stated, “MTN Uganda maintained a positive growth momentum in the first nine months of 2023, on account of solid commercial execution and the improved performance of the current macroeconomic environment.”

Key factors contributing to this success include:

- Customer Growth: MTN Uganda expanded its customer base and introduced over 360 additional service points to enhance customer experience.

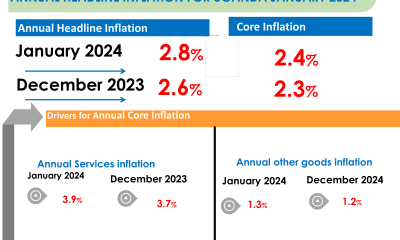

- Inflation Control: Inflation reduced significantly to an average of 3.3%, compared to 9.0% in the same period last year, supporting a 50 basis points reduction in the key lending rate to 9.5%.

- Data and 5G Technology: Investments in 4G and the introduction of 5G technology improved the user experience, resulting in a 51.0% growth in data traffic.

- Smartphone Adoption: Efforts to boost smartphone adoption were successful, with smartphone penetration increasing to 36.6%.

- Fintech Services: Fintech revenue surged by 18.1%, driven by peer-to-peer (P2P) and money transfers, along with increased adoption of the MoMo Pay platform.

- Digital Services: Digital revenue experienced extraordinary growth of 130.0%, driven by content value-added services and enterprise digital solutions.

MTN Uganda’s impressive financial performance is attributed to its strategic planning and execution. With the Ugandan economy showing resilience and strong growth, the company is well-positioned for future expansion.

Mulinge stated, “Our focus remains on maintaining the growth momentum of our overall portfolio with attention to new growth segments of home broadband, enterprise, and digital.”

She added that the company would continue to invest in areas like 5G, fiber deployment, and network enhancements, guided by a value-based capital allocation strategy and a commitment to maintaining a strong balance sheet.

In conclusion, MTN Uganda’s remarkable Q3 results underscore its commitment to innovation, customer satisfaction, and long-term growth in the dynamic telecommunications and digital services sector.

No surprise here given that they steal their agents cash in commission unlike Airtel Money which pays its Agents for all transactions, Mtn on the other hand doesn’t pay for Deposits and if they do you can’t tell how much you’ve earned and they even deduct their Agents commission for direct deposits claiming that the client has to have their phone with them during a transaction

So with that blatant daylight robbery it’s not surprising that they get such abnormal profits at the Agents expense. Mtn should know that we use our own money to run our businesses and at the end we expect a return on our investment not to benefit and increase their bottom line